COMMERCIAL PERFORMANCE

2019 – THE YEAR THE MARKET BOUNCED BACK

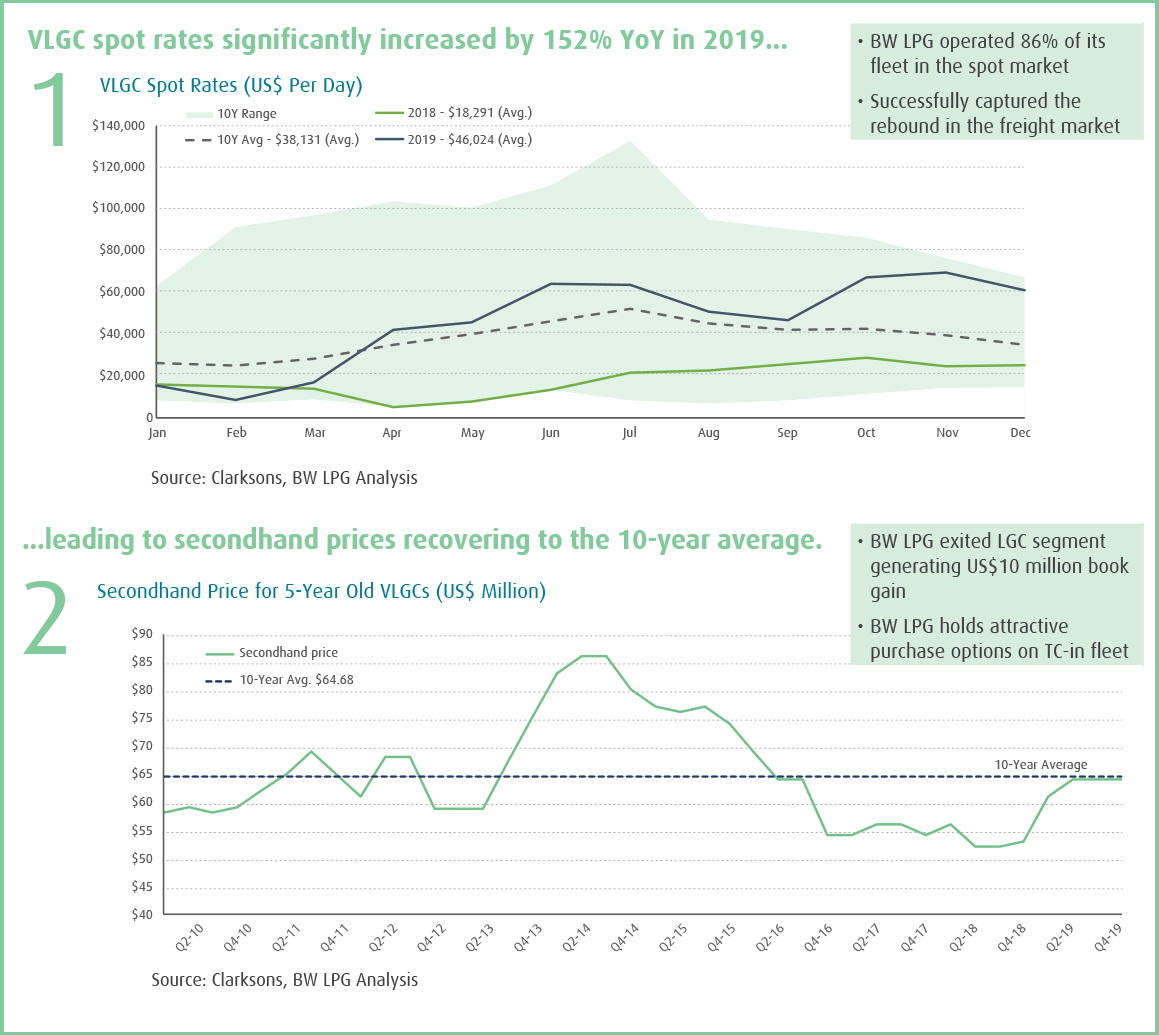

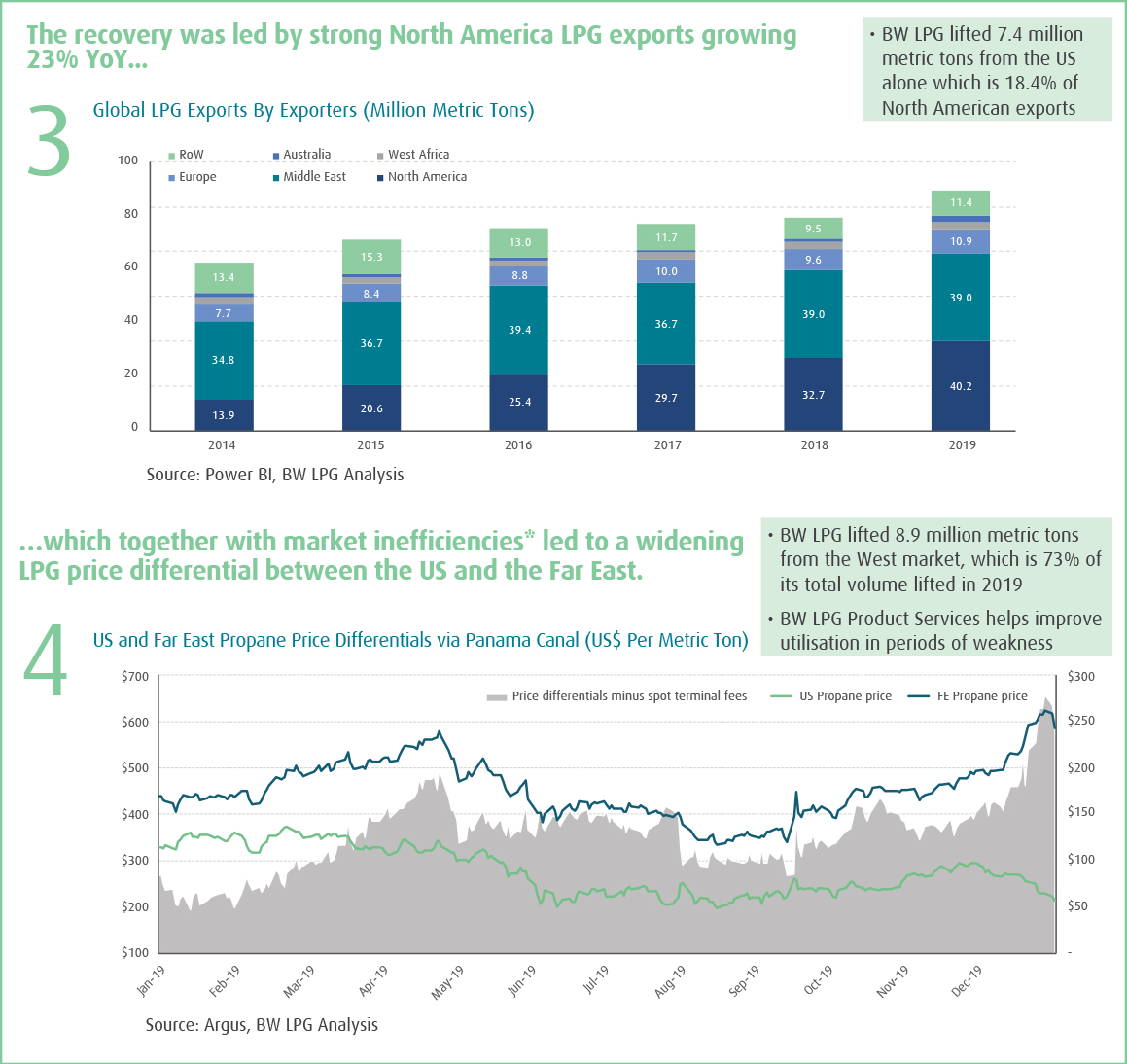

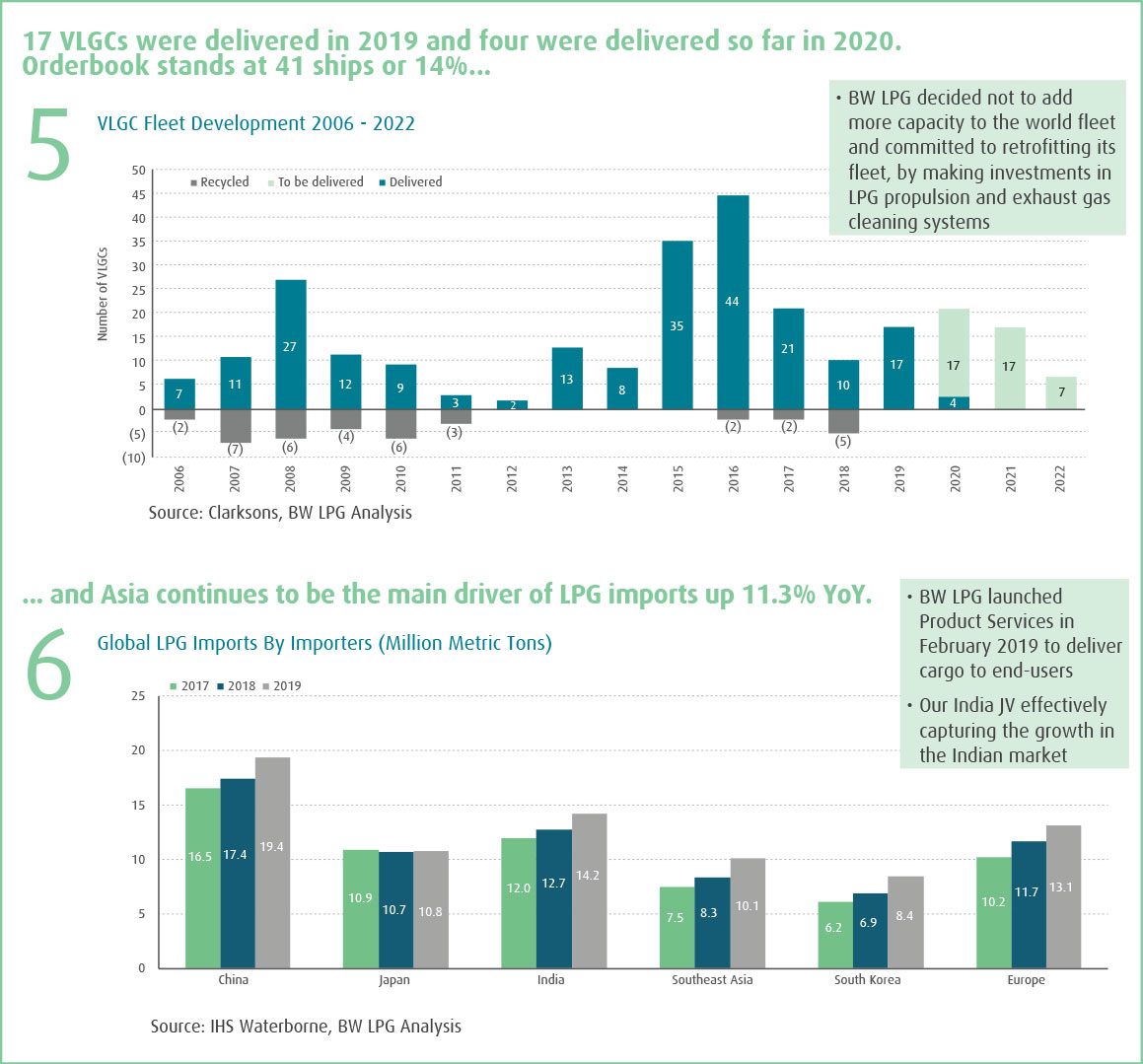

2019 can be characterised as the year that the VLGC market returned to profitability. The year started poorly due to the seasonal drop in demand for shipping in the first quarter, but improved over the course of the year. Delays at loading and discharging ports, congestion at the Panama Canal (an important gateway to the growing demand centers in the East) and delays due to availability of compliant fuels ahead of the IMO 2020 0.5% sulphur emissions regulations led to an increase in shipping supply inefficiencies, in a year when only 6.8% of new vessel capacity was added to the global fleet. Demand for VLGCs increased due to increased LPG supply from the US Gulf/US East Coast, supply disruptions in the Middle East Gulf and the US-China trade tariffs, which re-established longhaul trade from the US Gulf to South East Asia via the Cape of Good Hope. Our commercial utilisation improved from 90% in 2018 to 95% in 2019, reflecting a market with strong supply and demand fundamentals.

EARNINGS PERFORMANCE

In anticipation of a market recovery, fixed-rate contract coverage for BW LPG in 2019 was minimised at 14% of VLGC revenue days with the remainder on the spot market. BW LPG maintained its focus on the spot market, improved utilisation in a rising market, and deployed the fleet to markets generating premium earnings. The VLGC fleet generated Time-Charter Equivalent (TCE) income of US$535 million in 2019 over 15,275 days, generating an average TCE of US$35,000 per day; up 90% year-on-year (YoY) representing the strongest earnings performance since 2015. During 2019, BW LPG selectively extended existing time-charters on fixed rates and Contracts of Affreightment (CoAs), on floating index-linked pricing structures.

The BW LPG VLGC fleet

generated TCE income of

US$535

million

in 2019

15,275 days

generating an average TCE of

US$35,000

per day

(up 90% YoY)

Our commercial utilisation

improved from

90% in 2018 to

95%

in 2019

2019 MARKET IN SIX GRAPHS

* Market inefficiencies decrease the supply of vessels in the market and improve the fleet utilisation such as shipping delays due to bunkering,

canal transiting, port delays and other planned or unplanned off hires.

TIMING THE CYCLE

FLEET DEPLOYMENT

In 2019, the BW LPG VLGC fleet comprised 35 owned vessels with an average age of eight years, nine chartered-in vessels with an average age of nine years, two joint venture vessels and one chartered-in newbuilding. We are committed to investing US$106 million on fleet upgrades, which includes the installation of exhaust gas cleaning systems and retrofitting vessels with LPG dual-fuel propulsion engines.

At the end of 2019, the average remaining duration of our chartered-in vessels, including the chartered-in newbuildings and excluding the BW Empress on bareboat, was 4.2 years with an average rate of approximately US$26,000 per day, before profit sharing agreements. The majority of our chartered-in vessels have purchase options either during or at the end of the charter-in period. Three VLGC time-charters from long-term third-party owners (TC-in) were renewed in 2019 prior to the recovery in the spot market; the vessels continue to operate under BW LPG.

The two VLGCs operating under our joint venture in India continue to be gainfully employed with Indian Public Sector Units (PSU’s) at an average charter hire rate of US$40,625 per day. The first of two VLGC chartered-in newbuildings was delivered in November 2019 and is employed on the spot market. The second VLGC chartered-in newbuilding was delivered in February 2020.

In November 2019, BW LPG entered into a Memorandum of Agreement (MOA) to sell the last two LGCs with the first vessel delivered to the buyer in December 2019. The sale generated US$16 million in liquidity with a net book gain of US$5 million in 2019. The sale of the second vessel is expected to generate US$15 million in liquidity with a net book gain of US$5 million in 2020.

For 2020, 7% of the fleet is fixed on fixed-rate time-charters. Time-charter out contracts give our customers access to our vessels for an agreed time period on a fixed price per day with the customer paying voyage expenses, such as fuel and port costs.

As of 1 January 2020, the entire BW LPG fleet of owned and operated VLGCs is IMO 2020 compliant.

2019:

Average remaining duration of

chartered-in vessels was

4.2 years

with an average rate of approximately

US$26,000 per day

2 VLGCs

under a Joint Venture in India operate

at an average charter hire rate of

US$40,625

per day

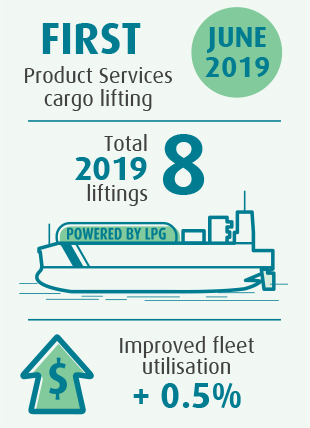

PRODUCT SERVICES:

ENHANCING OUR VALUE PROPOSITION

Powering integrated product and shipping solutions

In February 2019, BW LPG established a Product Services division to support our core shipping business, with the objective of enhancing our fleet utilisation which leads to improved earnings and returns for shareholders. This is part of our ambition to propose a low-risk and fully-integrated product delivery service to customers. Through this service, we purchase LPG and offer it delivered on the basis of Cost, Insurance, Freight (CIF), directly to the end user.

Operations commenced in Q2 2019 and by the end of Q4 2019 we had lifted eight VLGC cargoes out of the US. Whilst LPG shipping remains our core business, we aim to diversify our business offerings, innovate to capture market opportunities and provide a more comprehensive business solution to customers.