FINANCIAL PERFORMANCE

| 2019 US$ million |

2018 US$ million |

||

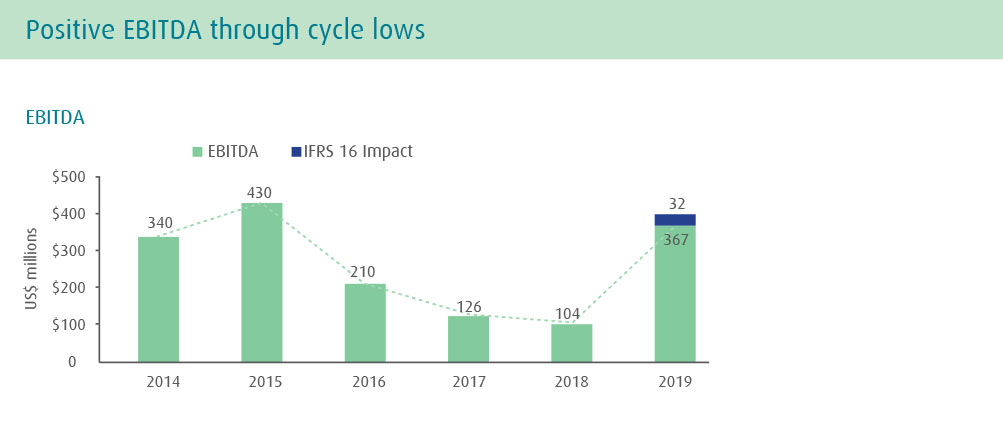

US$399mEBITDA |

Results TCE income EBITDA NPAT |

547 399 274 |

301 104 (72) |

| Balance Sheet | |||

US$274mNet profit after tax |

Vessel net book value Total assets Total cash and cash equivalents Total borrowings and lease liabilities Shareholders' equity |

1,904 2,549 112 1,282 1,177 |

2,006 2,260 50 1,235 984 |

| Cash Flows | |||

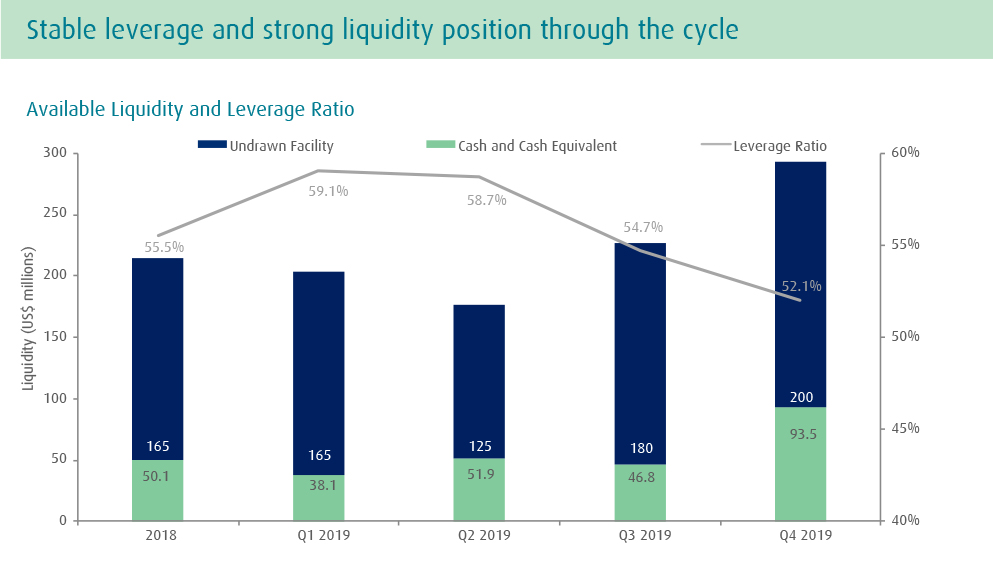

| Operating Investing Financing Available liquidity (including undrawn facility) |

322 50 (329) 294 |

89 76 (172) 215 |

US$118mTotal dividends paid |

Per Share Data | US$ | US$ |

| Earnings per share Net asset value per share Dividends per share |

1.97 8.31 0.85 |

(0.51) 7.01 - |

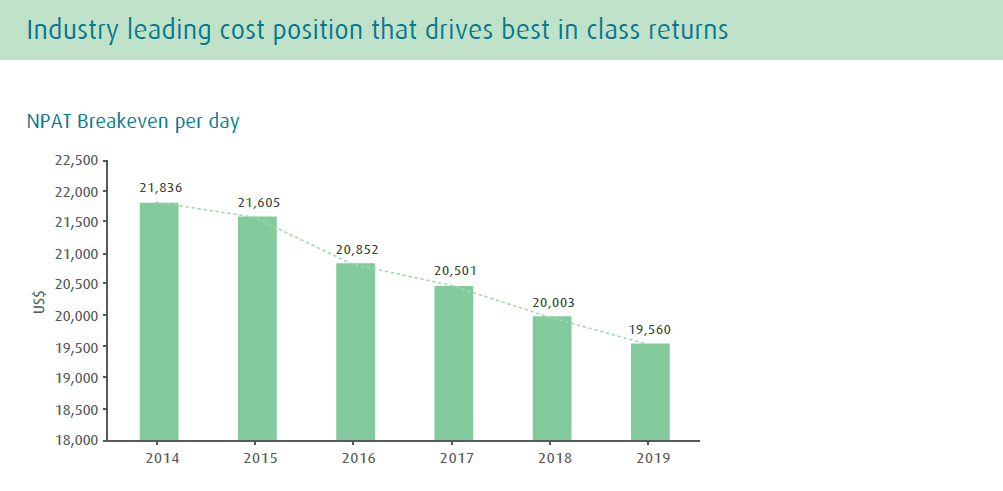

US$19,560NPAT breakdown per day |

Per Day Costs | ||

| Vessel calendar days OPEX per day* NPAT breakeven per day ** |

16,450 7,225 19,560 |

16,987 7,307 20,003 |

| Ratios | |||

| Earnings Yield Return on Equity Return on Capital Employed EBITDA Margin Leverage Ratio |

23.5% 25.3% 13.9% 72.9% 52.1% |

(16.9%) (7.0%) (1.1%) 34.6% 55.5% |

* Only for owned and bareboat-in vessels

** Adjusted for impairment charge / write-back of impairment charge on vessels, negative goodwill, and gain on derecognition of right-of-use assets