RISK MANAGEMENT

Transparent reporting by Executive Management, meticulous reviews by an international Board of Directors and a clear risk management framework are key elements of our corporate governance framework and these help us in creating long-term value for all stakeholders.

BW LPG strives to provide competitive risk-adjusted returns to shareholders. Risk management is an integral part of value delivery and is fundamental to our business decision-making process. We have designed our dynamic yet strategic risk management framework to ensure minimal impact from any unfavourable events and market conditions.

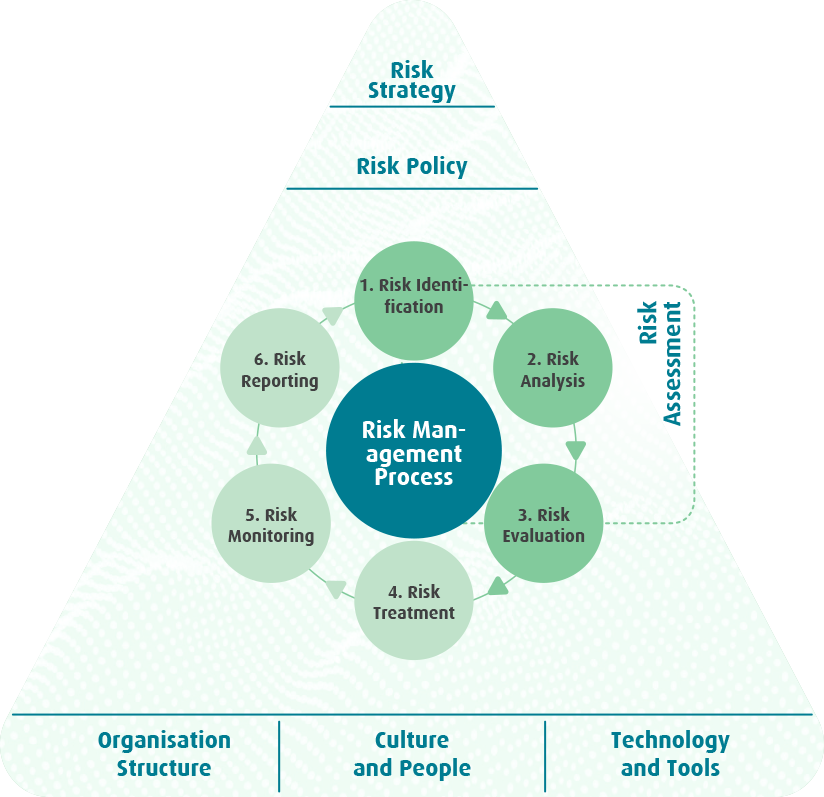

Our Enterprise Risk Management (ERM) is based on the principles from the ISO 31000 and the Committee of Sponsoring Organizations’ (COSO) ERM Framework. The risk management process is implemented using a risk register whereby all possible risks are considered, with applicability assessed in terms of impact and probability. This register supports risk identification and follow-up of critical risks and related improvement opportunities. We regularly monitor our risk framework, policy and review processes to ensure appropriate and efficient mitigation of risk.

STRATEGIC AND EXTERNAL RISKS

Strategic and external risks are risks that relate to the markets, countries, services and products, or from customers. They are addressed by the business strategies managed through our annual strategy review process. In this process, the Board of Directors review provides input on the Executive Management's assessment of strategic and external risks. The Executive Management is responsible for ensuring that the intended and actual business direction, changes in markets, customers' expectations and requirements are reflected in corporate strategic planning.

REGULATORY AND COMPLIANCE RISKS

Regulatory and compliance risks are risks associated with ethical behavior, both directly involving employees and through third parties or partners on behalf of BW LPG, with security of sensitive information; or related to compliance with laws and regulations, including environmental regulations, sanctions and anti-bribery laws. These risks are managed through regular monitoring and mandatory awareness training, compliance reviews, legal due diligence, and internal audit checks.

COMMERCIAL AND OPERATIONAL RISKS

Commercial and operational risks are risks related to events occurring during planning and execution of business operations, involving for example, cargo loss or damage, counterparties default, asset loss or damage, crew injury, or environmental damage. Appropriate control measures are incorporated in operations and insurance planning to mitigate these risks, with ongoing monitoring during execution to identify and address newly emerging risks. Incidents and near misses experienced are reviewed to ensure that their root causes are comprehensively analysed, with suitable corrective actions determined and implemented.

FINANCIAL RISKS

BW LPG's activities expose it to a variety of financial risks. The Company's overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise the potential adverse effects on financial performance. Where applicable, the Company uses financial instruments such as interest rate swaps, forex forward ontracts and bunker swaps to hedge certain financial risk exposures. The Company avoids speculation and risk management tools which may create new exposures as a result of their incompatibility with the risk targeted for mitigation. The financial risk management of the Company is handled by the Executive Management with guidance and input by the Board of Directors.